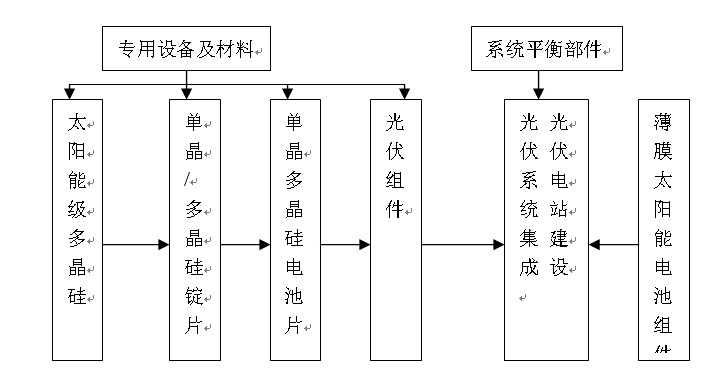

Laser Stage Light,Dmx Laser,Mini Laser Lighting,Led Laser Moving Head Big Dipper Laser Science And Technology Co., Ltd , https://www.bigdipper-laser.com Although the thin film battery is currently inefficient, the conversion efficiency of a thin film battery using a thin layer and a multi-pn junction structure can reach 40%-50%. Therefore, in the future, a high-efficiency battery will eventually take a thin film technical route. Among the various thin film batteries, only the silicon thin film battery has abundant raw material reserves, and is non-toxic and non-polluting, and has a more sustainable development prospect. The silicon thin film battery can be further divided into three types: an amorphous silicon film, a microcrystalline silicon film, and a polycrystalline silicon film. â–²The four major polysilicon technologies compare the most widely used crystalline silicon solar cells. The main raw material is polysilicon. For the preparation of polysilicon, there are mainly four processes, namely: modified Siemens method, silane method, circulating fluidization. Bed method, physical method. Among these four technologies, the improved Siemens method is the most mature and has been applied on a large scale. At present, 80% of the global polysilicon production adopts the modified Siemens method. The disadvantages are high cost and complicated by-product recycling technology. The silane method is currently only available. There is a company in the United States that has the advantages of high quality, shortcomings of high risk and high process requirements. The fluidized bed method can improve the utilization rate of raw materials in polysilicon production, and the cost is low. The disadvantage is that the technology is not mature enough. Currently, only the United States 1 Home companies use this technology; the biggest advantage of physical law is low cost, the disadvantage is that it does not solve the problem of industrial production, product stability is not enough, purity is not enough. â—†Photovoltaic Industry Chain Status For the current widely used crystalline silicon photovoltaic cell systems, the industrial chain mainly includes polysilicon-silicon ingots/silicon wafers-cells-components-photovoltaic system design and installation, etc. For thin film photovoltaic cell systems, Mainly battery components - photovoltaic system design and installation. Figure 1 Photovoltaic Industry Chain

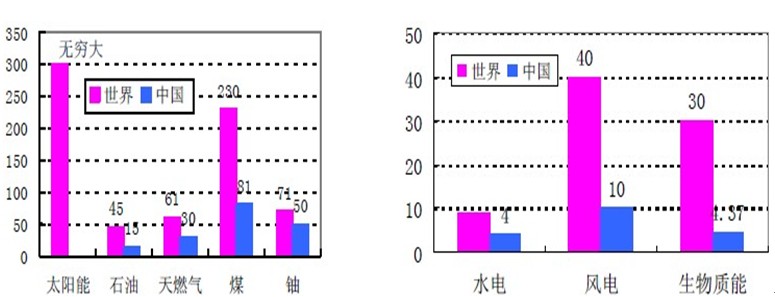

Although the thin film battery is currently inefficient, the conversion efficiency of a thin film battery using a thin layer and a multi-pn junction structure can reach 40%-50%. Therefore, in the future, a high-efficiency battery will eventually take a thin film technical route. Among the various thin film batteries, only the silicon thin film battery has abundant raw material reserves, and is non-toxic and non-polluting, and has a more sustainable development prospect. The silicon thin film battery can be further divided into three types: an amorphous silicon film, a microcrystalline silicon film, and a polycrystalline silicon film. ▲The four major polysilicon technologies compare the most widely used crystalline silicon solar cells. The main raw material is polysilicon. For the preparation of polysilicon, there are mainly four processes, namely: modified Siemens method, silane method, circulating fluidization. Bed method, physical method. Among these four technologies, the improved Siemens method is the most mature and has been applied on a large scale. At present, 80% of the global polysilicon production adopts the modified Siemens method. The disadvantages are high cost and complicated by-product recycling technology. The silane method is currently only available. There is a company in the United States that has the advantages of high quality, shortcomings of high risk and high process requirements. The fluidized bed method can improve the utilization rate of raw materials in polysilicon production, and the cost is low. The disadvantage is that the technology is not mature enough. Currently, only the United States 1 Home companies use this technology; the biggest advantage of physical law is low cost, the disadvantage is that it does not solve the problem of industrial production, product stability is not enough, purity is not enough. ◆Photovoltaic Industry Chain Status For the current widely used crystalline silicon photovoltaic cell systems, the industrial chain mainly includes polysilicon-silicon ingots/silicon wafers-cells-components-photovoltaic system design and installation, etc. For thin film photovoltaic cell systems, Mainly battery components - photovoltaic system design and installation. Figure 1 Photovoltaic Industry Chain  ★ Global photovoltaic power generation status ◆ Photovoltaic power generation is the most promising renewable energy Compared with petroleum, natural gas, coal, nuclear power and other energy forms, the biggest advantage of photovoltaic power generation is that resources are inexhaustible. Compared with renewable energy such as wind power, hydropower and biomass energy, the biggest advantage of photovoltaic power generation is that the resources available for mining are unlimited, while the number of hydropower and wind power developable is limited. According to estimates, the global solar energy resources can be as high as 600 billion. kilowatt. Figure 2 China and the world's major energy useful years (years) and recoverable amount (100 million kilowatts)

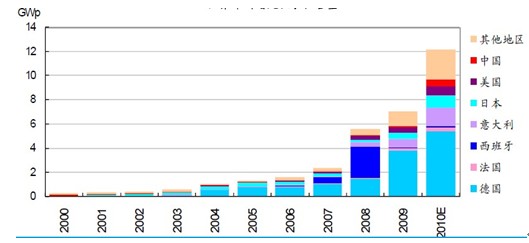

★ Global photovoltaic power generation status ◆ Photovoltaic power generation is the most promising renewable energy Compared with petroleum, natural gas, coal, nuclear power and other energy forms, the biggest advantage of photovoltaic power generation is that resources are inexhaustible. Compared with renewable energy such as wind power, hydropower and biomass energy, the biggest advantage of photovoltaic power generation is that the resources available for mining are unlimited, while the number of hydropower and wind power developable is limited. According to estimates, the global solar energy resources can be as high as 600 billion. kilowatt. Figure 2 China and the world's major energy useful years (years) and recoverable amount (100 million kilowatts)  ◆ The world's major PV market demand In 2010, the global PV installed capacity is expected to reach 12.2GWp [Wp, peak tile, solar cell output power under standard test conditions (25 ° C, AM 1.5, ie 1000 W / m). ], the year-on-year growth rate is over 60%. From the first half of the year, Germany's installed capacity is still growing rapidly under the dual impact of high subsidy levels and subsidies in the second half of the year. It is expected to reach 5.379 GWp throughout the year, but mainly in the first half of the year, and the installed capacity in the second half, especially in the fourth quarter, is expected to decline. However, as costs fall and subsidy prices stabilize, next year's yield will increase again, so next year's growth is also worth looking forward to; Italy and the Czech Republic are new hotspots, especially Italy, which has become the new global PV installation in 2009. The second largest market is expected to be close to 1.5GWp this year. Figure 3 Global PV installed capacity distribution

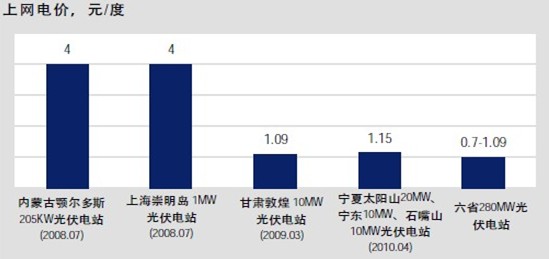

â—† The world's major PV market demand In 2010, the global PV installed capacity is expected to reach 12.2GWp [Wp, peak tile, solar cell output power under standard test conditions (25 ° C, AM 1.5, ie 1000 W / m). ], the year-on-year growth rate is over 60%. From the first half of the year, Germany's installed capacity is still growing rapidly under the dual impact of high subsidy levels and subsidies in the second half of the year. It is expected to reach 5.379 GWp throughout the year, but mainly in the first half of the year, and the installed capacity in the second half, especially in the fourth quarter, is expected to decline. However, as costs fall and subsidy prices stabilize, next year's yield will increase again, so next year's growth is also worth looking forward to; Italy and the Czech Republic are new hotspots, especially Italy, which has become the new global PV installation in 2009. The second largest market is expected to be close to 1.5GWp this year. Figure 3 Global PV installed capacity distribution  â–² Germany: a huge stable market Germany's installed capacity is mainly located in the southern Bayern state and Baden-Württemberg, its installed capacity share in 2009 was 39% and 14% respectively. ï® Photovoltaic system installation is mainly composed of civil and commercial components. <30kW systems are mostly civilian systems, and more than this scale are mostly commercial systems. Therefore, considering the future of the German market mainly needs to consider the changes in the influencing factors of the two sub-markets of civil and commercial. In the civilian market, the current penetration rate of private home rooftop PV systems is less than 6%. In fact, the high price of photovoltaic systems in the past few years has led families to be reluctant to bear high prices. Therefore, the market penetration rate of civil photovoltaic systems is still very low; in terms of return on investment, due to high subsidies for civil systems, before and after subsidy reduction, the return on investment and the payback period of PV-equipped regions with good natural conditions are still at a relatively high level. The bank interest rate is even higher than the long-term benefit of the securities market. Therefore, it is expected that the residents' installation enthusiasm will not be greatly reduced. Instead, they may increase their installed interest by worrying about the risks of other asset allocations and being resonated by environmental awareness. The civilian market is also closely related to installation capabilities and marketing. The German public is questioning the stability of the investment return of photovoltaic systems and the quality preservation of 20 years and above. Through the efforts of suppliers and system integrators to improve the design, facilitate installation, improve quality assurance and joint marketing, the German public is more reliable. Confidence and understanding, the civilian market has great potential to be tapped. In the commercial market, return on investment is the main factor. The higher leveraged commercial PV power plant system has a large change in the internal rate of return and the payback period before and after the subsidy change. In the first half of 2010, the application and installation climax of commercial systems reappeared: installed capacity increased significantly year-on-year, and most battery and component suppliers were in short supply. After the subsidy is cut, the commercial market may be hit hard, but the air-ground system subsidy will only drop by 11%, and integrators and suppliers can adopt personalized pricing and services for large orders, or bypass intermediate orders, reducing installation costs. It may make the return on investment level close to the pre-subsidy reduction level, and the commercial market will maintain growth, but the sudden surge in the type of December 2009 will be difficult to reproduce. In general, demand in the German market is expected to continue to grow in 2010, and the total installed capacity will reach 5.379GWp. â–²Italy: rapid rise In the 1990s, Italy was the third country in the world to build photovoltaic power plants. The government provides subsidies equal to 70-75% of the system cost by means of financial subsidies or tax deductions. The surplus electricity generated by the system is sold to local power companies at normal electricity prices. Since the price of electricity is at a high level in European countries, and the on-grid price is also at a high level in Europe, and the on-grid price is slow, Italy is an ideal market for photovoltaic systems under current conditions. The existing on-grid tariffs in Italy divide photovoltaic systems into three categories: complete building integration, partial building integration and independence. In 2009 and 2010, the on-grid tariffs were reduced by 2% from the 2008 levels. The photovoltaic system in Italy has a full life cycle photovoltaic power generation cost of 0.24 Euro/kWh. In comparison, the average retail price of civilian retail in Italy in 2009 was about 0.26 euros. Therefore, photovoltaic power generation in Italy has basically achieved parity on the Internet. In 2010, even if the PV system price was still 5 Euro/Wp, the small-scale BAPV (partially integrated photovoltaic) system in central Italy invested about 19% of the IRR, which still has strong investment attractiveness. ï®Integrated investment return rate, large-scale power station subsidy significantly reduced expectations, improved network approval efficiency, close to net parity and increased installed capacity, the Italian market is expected to grow by about 80% in 2010 to 1500MW. â–²Japan: Government support is long-lasting, targeted. Japan's photovoltaic power generation is also close to the Internet, and the photovoltaic industry is about to get rid of subsidies. The on-grid tariff for surplus electricity provided by the Japanese government has been basically close to the retail electricity price. The average retail electricity price in 2009 was about 23 yen/kWh, while the non-residential 10kWp grid-connected electricity price was 20 yen/kWh, which is lower than the retail price. . Combined with government subsidies, Japan's photovoltaic power generation has basically reached the parity of the Internet. Therefore, it can be expected that the Japanese PV market will continue to grow rapidly, with an expected growth rate of around 60%. In 2010, the newly installed capacity will reach 1GWp. The capacity expansion plan of Japanese PV companies has also confirmed to some extent that Japan's domestic market will achieve self-reliance and continue to grow: at the end of 2010, Japan's domestic PV production capacity will increase by 60% to more than 4GW. Japan's leading companies are the first in the world to achieve mass production of thin-film batteries, and the mass production of silicon thin-film batteries has been realized since the 1980s. At present, the share of thin film batteries in Japanese-made photovoltaic modules is gradually increasing. In 2009, Japan's CIGS/CIS thin-film battery production has exceeded 43MW, and the capacity utilization rate has exceeded 50%. The large-scale expansion of production capacity has been on the line and will challenge other products and suppliers in the market. The cumulative installed capacity of residential photovoltaic systems in Japan is 2,470,997 kWp, and the average installed capacity of each household is calculated at 5 kWp. The total installed system is about 494,200 households. The current total number of households in Japan is about 47 million. At the same time, a household uses about 1200 kWh of electricity per year, and calculates the return on internal investment according to the lighting conditions of different regions, and accordingly considers the possibility of investment and environmental protection for home installation. Therefore, under the current conditions, the market penetration rate of Japanese household photovoltaic systems is about 16%, and there is still much room for development. If Japan's retail electricity price rises further, PV system prices fall, or subsidized electricity prices increase, the potential market size will expand and the market development space will increase. â–²US: New growth point in PV market looming The US PV system installation subsidy policy model is different from European countries, mainly including tax deduction, initial installation subsidy and on-grid tariff, supplemented by other financing or approval support policies: tax policy subsidies by system A certain proportion of the initial installation cost is given; the initial installation subsidy is given according to the specified amount in the policy. The triggering factor of the subsidy adjustment is not the time for the new policy to be introduced, but the certain target installation amount; the California photovoltaic power generation support policy has been more than 10 years. History, a number of policy components "California to the Sunshine Program" (GSC) played an important role in the development of the California PV market. The CSI in the GSC is planned to target 1.8GW in 2016. It does not determine the subsidy for a certain period of time. Instead, it sets the 10-stage subsidy quota and the installed capacity target that triggers the next phase of subsidies, which also controls the total amount of subsidies. The NSHP in the GSC plans to target 0.4GW for 2016, and the total amount of FIT plan subsidies is controlled at 0.75GW. Therefore, CSI California's main photovoltaic support program. ï®2010 CSI subsidies will be 6 to 7 and 5 to 6, subsidies will drop by 30%-40%, and the system price is difficult to drop again. The 6th and 5th stages of the last bus have already appeared, this year April 1 Between the day and June 14, the unused amount in the previous stage is significantly lower than the previous stage conversion, and the total amount of the new stage has been reduced, that is, users (especially civil system users) have formed a consensus that the system price is difficult to fall. Expect to grab the system before the subsidy is lowered again. In the 1.5 months, the CSI project installed capacity of 132.45MW, which has exceeded half of the total installed capacity in California last year. ï® As the economy picks up, electricity prices may increase further, but lending rates may also increase, but even so, IRRs with highly leveraged projects have reached a high level, and system prices may continue to fall, making loans to build large-scale PV power plant projects. The rate of return has further increased. Unless the US economy is overheated, interest rates will increase, and investment tax credits may be abolished. However, system costs may have reached Germany's level, investment returns have been further improved, net prices have been realized, and the photovoltaic industry has been fully market-oriented. In fact, as of recently, the construction plan of US power station-level PV projects (tens to hundreds of megawatts, grid-connected) has reached about 6.5 GWp, including some of the largest super-large projects in the world. Therefore, the construction of photovoltaic power plants in the United States will continue to heat up. Considering the recovery of the US economy, the decline of subsidies in various states, and the relatively stable installation costs, and the controversy over the cause of the greenhouse effect in the United States, the US PV market is unlikely to explode in 2010, and will grow rapidly by about 75% to about 750 MWp. â–² China: Golden Sun shines China's photovoltaic power generation market demand development rate has been slow, in 2008 the proportion of the global installed capacity and the cumulative installed capacity is very low, in 2008 the cumulative installed capacity only accounted for the world total The capacity is 1%, and the new installed capacity is about 2%. ï® China's traditional electricity prices are relatively low, and the economics of using photovoltaic products to generate electricity are relatively insufficient. At the beginning of 2009, in order to further increase emission reduction efforts and help the healthy development of the domestic PV industry at the same time, the Chinese government issued a historic domestic PV subsidy program. With the orderly subsidies of the Golden Sun Project and the PV Roof Plan, according to incomplete statistics, the new capacity in the country reached 140MW in 2009. Photovoltaic faucets and power giants have signed extensive framework cooperation agreements and made exciting project plans. ï® It can be expected that under the promotion of the Golden Sun Project and the bidding project for 280MWp photovoltaic power station started in 2010, the installed capacity of new PV in China will reach or exceed 600MW in 2010. According to China News, 13 projects of China's 280MW PV concession bidding have been opened in Beijing on August 16th. In 135 bids, the average bid price is 0.7-1.09 yuan. The case must be paid a deposit of 5 million yuan. The deposit period is 14 months. In addition, the bidding company must have 10% of the project capital. The company's financing plan must have 30% of its own funds. Due to the high capital requirements, It is relatively beneficial to state-owned enterprises. Although the relevant state units said that the bidding case did not win the bid at the lowest price, due to the large scale, it attracted many state-owned units with strong financial strength. It is understood that the lowest price of 13 projects is reported by state-owned enterprises. Huaneng Power International (600011) and Guodian Power (600795) are the biggest winners of this tender. As far as the current situation is concerned, China's photovoltaic development path will be similar to that of wind power. The development of photovoltaic resources is the first to promote the development of photovoltaics. The state-owned enterprises are not aiming at project profit, but the main purpose is to achieve policy objectives. Obviously, from the price of this bid, the Chinese government is unacceptable for PV prices above RMB 1 and it is estimated that the average bid price of this bidding case may fall below RMB 1 (there is a chance to be lower than the price of offshore wind power). Through the industrialization and scale benefits, the annual PV power cost will be reduced by 5-7%. It is estimated that China's PV price will be reduced to 0.7-0.8 yuan within 5 years, gradually connecting with the market price, and the development of China's PV market. optimism. Table 2 China's light resource distribution area

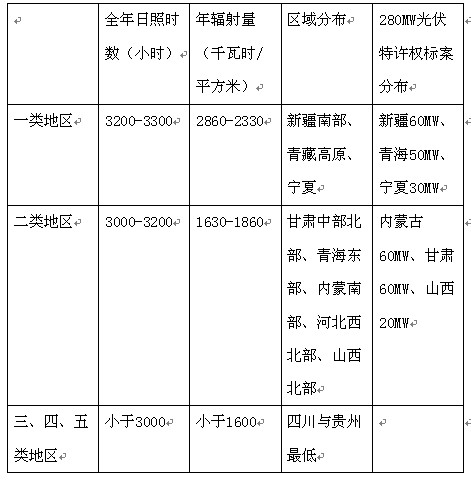

â–² Germany: a huge stable market Germany's installed capacity is mainly located in the southern Bayern state and Baden-Württemberg, its installed capacity share in 2009 was 39% and 14% respectively. ï® Photovoltaic system installation is mainly composed of civil and commercial components. <30kW systems are mostly civilian systems, and more than this scale are mostly commercial systems. Therefore, considering the future of the German market mainly needs to consider the changes in the influencing factors of the two sub-markets of civil and commercial. In the civilian market, the current penetration rate of private home rooftop PV systems is less than 6%. In fact, the high price of photovoltaic systems in the past few years has led families to be reluctant to bear high prices. Therefore, the market penetration rate of civil photovoltaic systems is still very low; in terms of return on investment, due to high subsidies for civil systems, before and after subsidy reduction, the return on investment and the payback period of PV-equipped regions with good natural conditions are still at a relatively high level. The bank interest rate is even higher than the long-term benefit of the securities market. Therefore, it is expected that the residents' installation enthusiasm will not be greatly reduced. Instead, they may increase their installed interest by worrying about the risks of other asset allocations and being resonated by environmental awareness. The civilian market is also closely related to installation capabilities and marketing. The German public is questioning the stability of the investment return of photovoltaic systems and the quality preservation of 20 years and above. Through the efforts of suppliers and system integrators to improve the design, facilitate installation, improve quality assurance and joint marketing, the German public is more reliable. Confidence and understanding, the civilian market has great potential to be tapped. In the commercial market, return on investment is the main factor. The higher leveraged commercial PV power plant system has a large change in the internal rate of return and the payback period before and after the subsidy change. In the first half of 2010, the application and installation climax of commercial systems reappeared: installed capacity increased significantly year-on-year, and most battery and component suppliers were in short supply. After the subsidy is cut, the commercial market may be hit hard, but the air-ground system subsidy will only drop by 11%, and integrators and suppliers can adopt personalized pricing and services for large orders, or bypass intermediate orders, reducing installation costs. It may make the return on investment level close to the pre-subsidy reduction level, and the commercial market will maintain growth, but the sudden surge in the type of December 2009 will be difficult to reproduce. In general, demand in the German market is expected to continue to grow in 2010, and the total installed capacity will reach 5.379GWp. â–²Italy: rapid rise In the 1990s, Italy was the third country in the world to build photovoltaic power plants. The government provides subsidies equal to 70-75% of the system cost by means of financial subsidies or tax deductions. The surplus electricity generated by the system is sold to local power companies at normal electricity prices. Since the price of electricity is at a high level in European countries, and the on-grid price is also at a high level in Europe, and the on-grid price is slow, Italy is an ideal market for photovoltaic systems under current conditions. The existing on-grid tariffs in Italy divide photovoltaic systems into three categories: complete building integration, partial building integration and independence. In 2009 and 2010, the on-grid tariffs were reduced by 2% from the 2008 levels. The photovoltaic system in Italy has a full life cycle photovoltaic power generation cost of 0.24 Euro/kWh. In comparison, the average retail price of civilian retail in Italy in 2009 was about 0.26 euros. Therefore, photovoltaic power generation in Italy has basically achieved parity on the Internet. In 2010, even if the PV system price was still 5 Euro/Wp, the small-scale BAPV (partially integrated photovoltaic) system in central Italy invested about 19% of the IRR, which still has strong investment attractiveness. ï®Integrated investment return rate, large-scale power station subsidy significantly reduced expectations, improved network approval efficiency, close to net parity and increased installed capacity, the Italian market is expected to grow by about 80% in 2010 to 1500MW. â–²Japan: Government support is long-lasting, targeted. Japan's photovoltaic power generation is also close to the Internet, and the photovoltaic industry is about to get rid of subsidies. The on-grid tariff for surplus electricity provided by the Japanese government has been basically close to the retail electricity price. The average retail electricity price in 2009 was about 23 yen/kWh, while the non-residential 10kWp grid-connected electricity price was 20 yen/kWh, which is lower than the retail price. . Combined with government subsidies, Japan's photovoltaic power generation has basically reached the parity of the Internet. Therefore, it can be expected that the Japanese PV market will continue to grow rapidly, with an expected growth rate of around 60%. In 2010, the newly installed capacity will reach 1GWp. The capacity expansion plan of Japanese PV companies has also confirmed to some extent that Japan's domestic market will achieve self-reliance and continue to grow: at the end of 2010, Japan's domestic PV production capacity will increase by 60% to more than 4GW. Japan's leading companies are the first in the world to achieve mass production of thin-film batteries, and the mass production of silicon thin-film batteries has been realized since the 1980s. At present, the share of thin film batteries in Japanese-made photovoltaic modules is gradually increasing. In 2009, Japan's CIGS/CIS thin-film battery production has exceeded 43MW, and the capacity utilization rate has exceeded 50%. The large-scale expansion of production capacity has been on the line and will challenge other products and suppliers in the market. The cumulative installed capacity of residential photovoltaic systems in Japan is 2,470,997 kWp, and the average installed capacity of each household is calculated at 5 kWp. The total installed system is about 494,200 households. The current total number of households in Japan is about 47 million. At the same time, a household uses about 1200 kWh of electricity per year, and calculates the return on internal investment according to the lighting conditions of different regions, and accordingly considers the possibility of investment and environmental protection for home installation. Therefore, under the current conditions, the market penetration rate of Japanese household photovoltaic systems is about 16%, and there is still much room for development. If Japan's retail electricity price rises further, PV system prices fall, or subsidized electricity prices increase, the potential market size will expand and the market development space will increase. â–²US: New growth point in PV market looming The US PV system installation subsidy policy model is different from European countries, mainly including tax deduction, initial installation subsidy and on-grid tariff, supplemented by other financing or approval support policies: tax policy subsidies by system A certain proportion of the initial installation cost is given; the initial installation subsidy is given according to the specified amount in the policy. The triggering factor of the subsidy adjustment is not the time for the new policy to be introduced, but the certain target installation amount; the California photovoltaic power generation support policy has been more than 10 years. History, a number of policy components "California to the Sunshine Program" (GSC) played an important role in the development of the California PV market. The CSI in the GSC is planned to target 1.8GW in 2016. It does not determine the subsidy for a certain period of time. Instead, it sets the 10-stage subsidy quota and the installed capacity target that triggers the next phase of subsidies, which also controls the total amount of subsidies. The NSHP in the GSC plans to target 0.4GW for 2016, and the total amount of FIT plan subsidies is controlled at 0.75GW. Therefore, CSI California's main photovoltaic support program. ï®2010 CSI subsidies will be 6 to 7 and 5 to 6, subsidies will drop by 30%-40%, and the system price is difficult to drop again. The 6th and 5th stages of the last bus have already appeared, this year April 1 Between the day and June 14, the unused amount in the previous stage is significantly lower than the previous stage conversion, and the total amount of the new stage has been reduced, that is, users (especially civil system users) have formed a consensus that the system price is difficult to fall. Expect to grab the system before the subsidy is lowered again. In the 1.5 months, the CSI project installed capacity of 132.45MW, which has exceeded half of the total installed capacity in California last year. ï® As the economy picks up, electricity prices may increase further, but lending rates may also increase, but even so, IRRs with highly leveraged projects have reached a high level, and system prices may continue to fall, making loans to build large-scale PV power plant projects. The rate of return has further increased. Unless the US economy is overheated, interest rates will increase, and investment tax credits may be abolished. However, system costs may have reached Germany's level, investment returns have been further improved, net prices have been realized, and the photovoltaic industry has been fully market-oriented. In fact, as of recently, the construction plan of US power station-level PV projects (tens to hundreds of megawatts, grid-connected) has reached about 6.5 GWp, including some of the largest super-large projects in the world. Therefore, the construction of photovoltaic power plants in the United States will continue to heat up. Considering the recovery of the US economy, the decline of subsidies in various states, and the relatively stable installation costs, and the controversy over the cause of the greenhouse effect in the United States, the US PV market is unlikely to explode in 2010, and will grow rapidly by about 75% to about 750 MWp. â–² China: Golden Sun shines China's photovoltaic power generation market demand development rate has been slow, in 2008 the proportion of the global installed capacity and the cumulative installed capacity is very low, in 2008 the cumulative installed capacity only accounted for the world total The capacity is 1%, and the new installed capacity is about 2%. ï® China's traditional electricity prices are relatively low, and the economics of using photovoltaic products to generate electricity are relatively insufficient. At the beginning of 2009, in order to further increase emission reduction efforts and help the healthy development of the domestic PV industry at the same time, the Chinese government issued a historic domestic PV subsidy program. With the orderly subsidies of the Golden Sun Project and the PV Roof Plan, according to incomplete statistics, the new capacity in the country reached 140MW in 2009. Photovoltaic faucets and power giants have signed extensive framework cooperation agreements and made exciting project plans. ï® It can be expected that under the promotion of the Golden Sun Project and the bidding project for 280MWp photovoltaic power station started in 2010, the installed capacity of new PV in China will reach or exceed 600MW in 2010. According to China News, 13 projects of China's 280MW PV concession bidding have been opened in Beijing on August 16th. In 135 bids, the average bid price is 0.7-1.09 yuan. The case must be paid a deposit of 5 million yuan. The deposit period is 14 months. In addition, the bidding company must have 10% of the project capital. The company's financing plan must have 30% of its own funds. Due to the high capital requirements, It is relatively beneficial to state-owned enterprises. Although the relevant state units said that the bidding case did not win the bid at the lowest price, due to the large scale, it attracted many state-owned units with strong financial strength. It is understood that the lowest price of 13 projects is reported by state-owned enterprises. Huaneng Power International (600011) and Guodian Power (600795) are the biggest winners of this tender. As far as the current situation is concerned, China's photovoltaic development path will be similar to that of wind power. The development of photovoltaic resources is the first to promote the development of photovoltaics. The state-owned enterprises are not aiming at project profit, but the main purpose is to achieve policy objectives. Obviously, from the price of this bid, the Chinese government is unacceptable for PV prices above RMB 1 and it is estimated that the average bid price of this bidding case may fall below RMB 1 (there is a chance to be lower than the price of offshore wind power). Through the industrialization and scale benefits, the annual PV power cost will be reduced by 5-7%. It is estimated that China's PV price will be reduced to 0.7-0.8 yuan within 5 years, gradually connecting with the market price, and the development of China's PV market. optimism. Table 2 China's light resource distribution area  Annual sunshine hours (hours) annual radiation (kWh/m2) regional distribution 280MW photovoltaic concession standard distribution category 3200-33002860-2330 southern Xinjiang, Qinghai-Tibet Plateau, Ningxia Xinjiang 60MW, Qinghai 50MW, Ningxia 30MW The second category is 3000-32001630-1860 in the central part of central Gansu, eastern Qinghai, southern Inner Mongolia, northwestern Hebei, northwestern Shanxi, Inner Mongolia 60MW, Gansu 60MW, Shanxi 20MW, third, fourth and fifth regions less than 3000 less than 1600 Sichuan and Guizhou lowest map four 280MW The price of photovoltaic concession bids will fall below 1 yuan

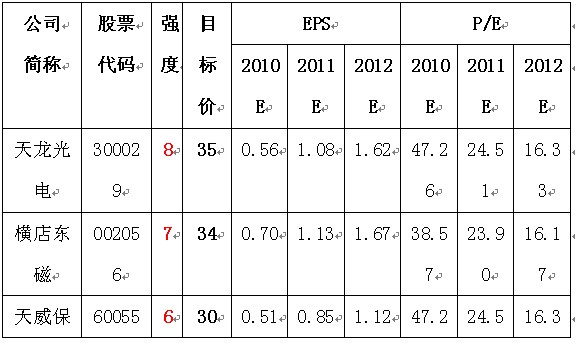

Annual sunshine hours (hours) annual radiation (kWh/m2) regional distribution 280MW photovoltaic concession standard distribution category 3200-33002860-2330 southern Xinjiang, Qinghai-Tibet Plateau, Ningxia Xinjiang 60MW, Qinghai 50MW, Ningxia 30MW The second category is 3000-32001630-1860 in the central part of central Gansu, eastern Qinghai, southern Inner Mongolia, northwestern Hebei, northwestern Shanxi, Inner Mongolia 60MW, Gansu 60MW, Shanxi 20MW, third, fourth and fifth regions less than 3000 less than 1600 Sichuan and Guizhou lowest map four 280MW The price of photovoltaic concession bids will fall below 1 yuan  ★ Focus on individual stocks Comprehensive consideration of the company's growth and future profitability, combined with the current market conditions, we recommend the focus of order: Tianlong Optoelectronics, Hengdian East Magnetic, Tianwei Baobian, Xindaxincai, Haitong Group, Sanan Optoelectronics, Rongxin Shares, CSG A.

★ Focus on individual stocks Comprehensive consideration of the company's growth and future profitability, combined with the current market conditions, we recommend the focus of order: Tianlong Optoelectronics, Hengdian East Magnetic, Tianwei Baobian, Xindaxincai, Haitong Group, Sanan Optoelectronics, Rongxin Shares, CSG A.

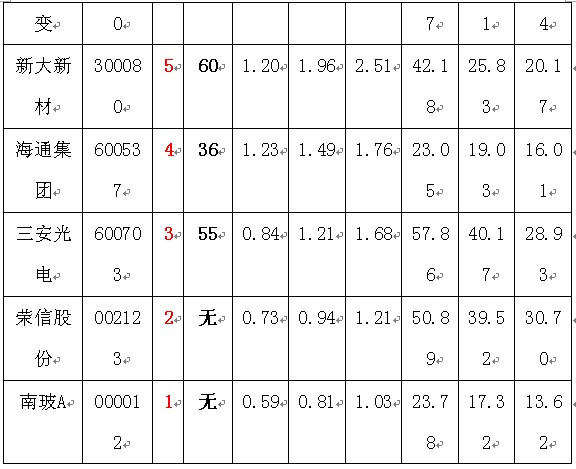

â–² Interim report meets expectations Tianlong Optoelectronics announced a net profit of 35.84 million yuan in the first half of 2010, a year-on-year increase of 44.7%, earnings per share of 0.18 yuan. In the first half of the year, the company's gross profit margin was 33.7%, of which the gross profit margin in the second quarter fell by 7.8 percentage points to 31%, mainly due to the increase in raw material prices of single crystal furnaces in the second quarter, and the company's products began to raise prices at the end of the second quarter. Interest rates are expected to rebound significantly in the second half of the year, and the full-year gross profit margin is estimated at 34%-35%. â–² Single-crystal furnace sales growth is strong, new products are expected to be shipped in the second half of the year. The sales revenue of the company's single crystal furnace is 174 million yuan. It increased by 76% year-on-year. According to the current order arrangement, sales volume is expected to increase by 58% in the second half of the year, and the annual sales volume will reach 700 units. The company's new products, polysilicon ingot furnace and sapphire crystal furnace, have entered the order negotiation stage. It is expected that the fourth quarter is expected to be shipped slightly, and the sales revenue growth in the second half will be further enhanced. â–² Acquired the upstream graphite thermal field enterprise, opened the industrial chain integration prologue company recently announced the acquisition of 68% equity of Shanghai James, the company is the production of graphite thermal field enterprises, net profit of 2009 more than 12 million yuan, the first half of 2010 The profit is over 10 million. The thermal field is a product used in single crystal furnaces and polycrystalline furnaces, which plays a key role in the quality and power consumption of single crystal silicon rods or polycrystalline silicon ingots. At present, the domestic market scale is about 800 million yuan. Through the vertical combination of the industrial chain, it is beneficial for downstream customers to complete the equipment supporting the production and operation, and promote the sales of the single crystal silicon furnace. It can also use the company's current customer resources to expand Sales of graphite thermal field products. â–² 6-12 month target price: 35 yuan. Give the company 2010-2012 EPS0.56/1.08/1.62 yuan. The corresponding PEs are 47.26/24.51/16.33. â—† Hengdian East Magnetic (002056) â–² Magnet Manufacturing Leading Hengdian East Magnetic is the largest magnet manufacturer in China and one of the largest magnet manufacturers in the world. Its soft magnets and permanent magnets all produce more than 10,000 tons, which is the only company in China that has reached this standard. In terms of production scale, the company is a well-deserved global leader in magnet manufacturing. â–² Cell manufacturing is a better PV industry intervention point. From the comparison of the four main links of photovoltaic industry chain such as polysilicon manufacturing, wafer manufacturing, cell manufacturing and component manufacturing, cell manufacturing still has the highest return on investment. Rate, and both mature and highly standardized manufacturing processes. From the perspective of the development of the domestic photovoltaic industry, the facts show that companies involved in the PV industry from battery cells have achieved quite satisfactory development. â–²Motor magnetic tile space is huge The company currently has a global market share of about 10% in motor magnetic tiles, and there is still huge room for improvement. It is conservatively expected that the demand for permanent ferrites from the automotive industry will be more than 360,000 tons worldwide, and the market capacity will be around 5.5 billion per year globally. The forecast for the overall market capacity of motor magnetic tiles is conservatively estimated at more than 8 billion per year. â–²High-conductivity iron and nickel oxides have a promising global market share of 30%, while high-conductivity ferrite (manganese-zinc) and nickel-zinc ferrite have a global market share of only 7% and 5%. Broad prospects. Mobile communication devices and flat-panel TVs are among the larger and more representative downstream markets. â–² 6-12 month target price: 34 yuan. The EPS granted to the company for 2010-2012 was 0.7/1.13/1.67 yuan respectively. The corresponding PEs are 38.57/23.90/16.17. â—† Tianwei Baobian (600550) â–² The interim report basically meets expectations. The company released the 2010 semi-annual report. In the first half of the year, the company's operating income was 3.31 billion yuan, a year-on-year increase of 4.8%; the net profit attributable to the parent company was 414 million yuan, down 2.1% year-on-year. â–² Transformer business will rely on ultra-high voltage, UHV products The domestic power market is slowing down, and the capacity of transformer manufacturers has increased significantly, resulting in imbalanced supply and demand in the market and increasingly fierce competition. During the 12th Five-Year Plan period, the State Grid will invest 270 billion yuan to build a UHV grid. The company's future transmission and distribution business will further tilt toward high-pressure, ultra-high-pressure and ultra-high-voltage businesses with core competitiveness. In the first half of the year, the company won the bid for 17 sets of 750kV transformers from the State Grid of India. The expansion of the company's high-voltage products in Russia, India and the domestic market will be the growth driver of the company's transformer business. â–² Tianwei Yingli contributed investment income growth In the first half of the year, Yingli contributed investment income of 97 million yuan, and the sales price has increased by 5%. It is expected that the company's net profit margin will rebound to more than 10% in the second half of the year. The Yingli 400MW PV module production line is expected to be put into production during the year, when the total production capacity will reach 1GW. As the company's current orders have exceeded 4GW, future revenue growth is mainly dependent on the release of capacity. We expect earnings to contribute 265 million yuan in investment income throughout the year and will continue to increase in the later period. â–² Polysilicon is expected to perform in the second half of the year The company's three polysilicon manufacturing companies have a total equity production capacity of 3,450 tons. In the first half of the year, polysilicon maintained a low price of more than 50 US dollars, contributing less investment income. Currently, the spot price of polysilicon is close to 70 US dollars. It is expected to increase in the second half of the year. Therefore, we believe that the net profit level of polysilicon business will be basically the same as last year. About 14%. ï€ â–²6-12 month target price: 30 yuan. The EPS granted to the company in 2010-2012 was 0.51/0.85/1.12 yuan respectively. The corresponding PEs are 47.27/24.51/16.34. â—† New Daxin Materials (300080) â–²In the second half of the year, the photovoltaic industry will maintain a high degree of prosperity. The company's performance or the over-expected PV industry's business climate is still high. Considering that the orders for PV products are generally medium and long, we believe that the second half of the PV The prosperity of the industry will be comparable to that of the first half of the year. According to Solarbuzz, global PV installed capacity reached 2.5GW in the first quarter of this year. In its latest quarterly report, Solarbuzz raised its forecast for global PV installed capacity to 15.2GW this year, doubling last year. â–²Using super-raised funds to promote the company's industrial chain and capacity expansion The company announced in July that it will use super-raised funds to invest in Xinjiang's 50,000-ton silicon carbide micro-powder project and the 25,000-ton cutting blade project. The 50,000-ton silicon carbide micropowder project will solve the company's already-built 15,000-ton cutting edge material project and the raw materials needed to raise 25,000 tons of cutting edge material. With the launch of 25,000 tons of cutting edge material project at the end of this year and the 25,000 tons of cutting edge material project in the second half of next year, the cutting edge production capacity will be expanded to 65,000 tons. â–²Recycling waste mortar project will provide double insurance for the company's cooperation with customers. The use of recycled silicon carbide scrap and recycled cutting fluid is gradually increasing, and the gross profit margin of more than 50% will also push all funds into the field. The company's 22,000 tons of recycled waste mortar fundraising project will ensure the company's cooperation with large customers such as LDK and Yingli Energy. Recycling waste mortar projects are profitable in the short term, and long-term is another attractive supplement to customer cooperation. â–² 6-12 month target price: 60 yuan. The EPS granted to the company in 2010-2012 was 1.20/1.96/2.51 yuan respectively. The corresponding PEs are 42.18/25.83/20.17 respectively. â—† Haitong Group (600537) â–² The company's restructuring was approved by the Ministry of Commerce, and high-quality PV assets could be injected. The company announced that the Ministry of Commerce agreed in principle to the replacement of Changzhou Yijing Optoelectronics and Haitong Group. Although the review by the China Securities Regulatory Commission will take time, it is more likely that the reorganization will not be financed. I believe that the long wait for asset injection may be about to pay off. If the restructuring is successful, the listed company will own 100% equity of Changzhou Yijing Optoelectronics, and thus become a vertically integrated large-scale photovoltaic enterprise. Yijing Optoelectronics has outstanding competitive advantages in the domestic PV market: 1) Vertical integration and integrated production mode, cost control and quality control are strong; 2) Management structure is compact, and decision-making and execution efficiency are high. It is easy to achieve rapid development in the market boom cycle. In 2010, the company's production capacity will expand from 200MW to 400MW, and it plans to expand to 1GW within three years to join the first echelon of the domestic PV industry. â–²In the first half of this year, PV spot supply is tight, and the future will continue to be booming. This year, due to the high return on investment, the European PV market continues to heat up. At present, the spot market in the supply side has been reluctant to sell, and the prices of polysilicon, silicon wafers, battery chips and components all show a strong trend. At present, domestic large factories including Yijing Optoelectronics have a full-scale production in full year. We believe that the photovoltaic market will continue to support the economy: 1) countries supporting the photovoltaic market will expand from individual countries to many economies around the world; 2) the approach of affordable Internet access will enable photovoltaic power generation to usher in the dawn of large-scale commercial operation; 3) Photovoltaic In the next 10 years, the cost leadership will be strengthened and will become the main technical means for the development of new energy. â–²The global PV market has gained growth opportunities. China's PV industry has benefited the most. With the new installations in Germany, Italy, the United States and the Czech Republic, it is expected to increase significantly on the basis of last year. Many authoritative research institutions have continuously raised the forecast for new installations this year. capacity. In 2010, it will increase by 90% to 12.2GW. In the next three years, the new installed base compound growth rate of 40%; considering the price decline factor, the solar cell market capacity compound growth rate of 33%. The price of polysilicon will remain relatively low, and the cost advantage of alternative technologies such as thin film is no longer the mainstream of crystalline silicon cells. Chinese companies will be able to continuously expand their market share due to the strengthening of cost advantages and the outbreak of domestic and foreign markets, and establish advantageous market advantages. â–²2010 P/E ratio is less than 24 times, and the compound growth rate in the future is over 30% According to local media reports, in the first half of the year, EJ Optoelectronics achieved sales of nearly 1.5 billion yuan and profit of 350 million yuan. The sales target of 3.8 billion yuan for the whole year is expected to exceed. The company's new capacity is expected to increase in the third quarter, and shipments in the second half of the year are expected to be 1.5 times that of the first half of the year. As the ex-factory price of components in the second half of the year rose slightly, the average price is expected to be no lower than the first half of the year, and the cost is basically stable, so the company's second half results will be significantly better than the first half. â–² 6-12 month target price: 36 yuan. The EPS granted to the company for 2010-2012 was 1.23/1.49/1.76 yuan respectively. The corresponding PEs are 23.05/19.03/16.01. â—† Other PV industry companies can pay attention â–² Sanan Optoelectronics (600703), target price of 6-12 months: 55 yuan. â–² Rongxin shares (002123), 6-12 months target price: no. â–² CSG A (000012), 6-12 months target price: no.

â–² Interim report meets expectations Tianlong Optoelectronics announced a net profit of 35.84 million yuan in the first half of 2010, a year-on-year increase of 44.7%, earnings per share of 0.18 yuan. In the first half of the year, the company's gross profit margin was 33.7%, of which the gross profit margin in the second quarter fell by 7.8 percentage points to 31%, mainly due to the increase in raw material prices of single crystal furnaces in the second quarter, and the company's products began to raise prices at the end of the second quarter. Interest rates are expected to rebound significantly in the second half of the year, and the full-year gross profit margin is estimated at 34%-35%. â–² Single-crystal furnace sales growth is strong, new products are expected to be shipped in the second half of the year. The sales revenue of the company's single crystal furnace is 174 million yuan. It increased by 76% year-on-year. According to the current order arrangement, sales volume is expected to increase by 58% in the second half of the year, and the annual sales volume will reach 700 units. The company's new products, polysilicon ingot furnace and sapphire crystal furnace, have entered the order negotiation stage. It is expected that the fourth quarter is expected to be shipped slightly, and the sales revenue growth in the second half will be further enhanced. â–² Acquired the upstream graphite thermal field enterprise, opened the industrial chain integration prologue company recently announced the acquisition of 68% equity of Shanghai James, the company is the production of graphite thermal field enterprises, net profit of 2009 more than 12 million yuan, the first half of 2010 The profit is over 10 million. The thermal field is a product used in single crystal furnaces and polycrystalline furnaces, which plays a key role in the quality and power consumption of single crystal silicon rods or polycrystalline silicon ingots. At present, the domestic market scale is about 800 million yuan. Through the vertical combination of the industrial chain, it is beneficial for downstream customers to complete the equipment supporting the production and operation, and promote the sales of the single crystal silicon furnace. It can also use the company's current customer resources to expand Sales of graphite thermal field products. â–² 6-12 month target price: 35 yuan. Give the company 2010-2012 EPS0.56/1.08/1.62 yuan. The corresponding PEs are 47.26/24.51/16.33. â—† Hengdian East Magnetic (002056) â–² Magnet Manufacturing Leading Hengdian East Magnetic is the largest magnet manufacturer in China and one of the largest magnet manufacturers in the world. Its soft magnets and permanent magnets all produce more than 10,000 tons, which is the only company in China that has reached this standard. In terms of production scale, the company is a well-deserved global leader in magnet manufacturing. â–² Cell manufacturing is a better PV industry intervention point. From the comparison of the four main links of photovoltaic industry chain such as polysilicon manufacturing, wafer manufacturing, cell manufacturing and component manufacturing, cell manufacturing still has the highest return on investment. Rate, and both mature and highly standardized manufacturing processes. From the perspective of the development of the domestic photovoltaic industry, the facts show that companies involved in the PV industry from battery cells have achieved quite satisfactory development. â–²Motor magnetic tile space is huge The company currently has a global market share of about 10% in motor magnetic tiles, and there is still huge room for improvement. It is conservatively expected that the demand for permanent ferrites from the automotive industry will be more than 360,000 tons worldwide, and the market capacity will be around 5.5 billion per year globally. The forecast for the overall market capacity of motor magnetic tiles is conservatively estimated at more than 8 billion per year. â–²High-conductivity iron and nickel oxides have a promising global market share of 30%, while high-conductivity ferrite (manganese-zinc) and nickel-zinc ferrite have a global market share of only 7% and 5%. Broad prospects. Mobile communication devices and flat-panel TVs are among the larger and more representative downstream markets. â–² 6-12 month target price: 34 yuan. The EPS granted to the company for 2010-2012 was 0.7/1.13/1.67 yuan respectively. The corresponding PEs are 38.57/23.90/16.17. â—† Tianwei Baobian (600550) â–² The interim report basically meets expectations. The company released the 2010 semi-annual report. In the first half of the year, the company's operating income was 3.31 billion yuan, a year-on-year increase of 4.8%; the net profit attributable to the parent company was 414 million yuan, down 2.1% year-on-year. â–² Transformer business will rely on ultra-high voltage, UHV products The domestic power market is slowing down, and the capacity of transformer manufacturers has increased significantly, resulting in imbalanced supply and demand in the market and increasingly fierce competition. During the 12th Five-Year Plan period, the State Grid will invest 270 billion yuan to build a UHV grid. The company's future transmission and distribution business will further tilt toward high-pressure, ultra-high-pressure and ultra-high-voltage businesses with core competitiveness. In the first half of the year, the company won the bid for 17 sets of 750kV transformers from the State Grid of India. The expansion of the company's high-voltage products in Russia, India and the domestic market will be the growth driver of the company's transformer business. â–² Tianwei Yingli contributed investment income growth In the first half of the year, Yingli contributed investment income of 97 million yuan, and the sales price has increased by 5%. It is expected that the company's net profit margin will rebound to more than 10% in the second half of the year. The Yingli 400MW PV module production line is expected to be put into production during the year, when the total production capacity will reach 1GW. As the company's current orders have exceeded 4GW, future revenue growth is mainly dependent on the release of capacity. We expect earnings to contribute 265 million yuan in investment income throughout the year and will continue to increase in the later period. â–² Polysilicon is expected to perform in the second half of the year The company's three polysilicon manufacturing companies have a total equity production capacity of 3,450 tons. In the first half of the year, polysilicon maintained a low price of more than 50 US dollars, contributing less investment income. Currently, the spot price of polysilicon is close to 70 US dollars. It is expected to increase in the second half of the year. Therefore, we believe that the net profit level of polysilicon business will be basically the same as last year. About 14%. ï€ â–²6-12 month target price: 30 yuan. The EPS granted to the company in 2010-2012 was 0.51/0.85/1.12 yuan respectively. The corresponding PEs are 47.27/24.51/16.34. â—† New Daxin Materials (300080) â–²In the second half of the year, the photovoltaic industry will maintain a high degree of prosperity. The company's performance or the over-expected PV industry's business climate is still high. Considering that the orders for PV products are generally medium and long, we believe that the second half of the PV The prosperity of the industry will be comparable to that of the first half of the year. According to Solarbuzz, global PV installed capacity reached 2.5GW in the first quarter of this year. In its latest quarterly report, Solarbuzz raised its forecast for global PV installed capacity to 15.2GW this year, doubling last year. â–²Using super-raised funds to promote the company's industrial chain and capacity expansion The company announced in July that it will use super-raised funds to invest in Xinjiang's 50,000-ton silicon carbide micro-powder project and the 25,000-ton cutting blade project. The 50,000-ton silicon carbide micropowder project will solve the company's already-built 15,000-ton cutting edge material project and the raw materials needed to raise 25,000 tons of cutting edge material. With the launch of 25,000 tons of cutting edge material project at the end of this year and the 25,000 tons of cutting edge material project in the second half of next year, the cutting edge production capacity will be expanded to 65,000 tons. â–²Recycling waste mortar project will provide double insurance for the company's cooperation with customers. The use of recycled silicon carbide scrap and recycled cutting fluid is gradually increasing, and the gross profit margin of more than 50% will also push all funds into the field. The company's 22,000 tons of recycled waste mortar fundraising project will ensure the company's cooperation with large customers such as LDK and Yingli Energy. Recycling waste mortar projects are profitable in the short term, and long-term is another attractive supplement to customer cooperation. â–² 6-12 month target price: 60 yuan. The EPS granted to the company in 2010-2012 was 1.20/1.96/2.51 yuan respectively. The corresponding PEs are 42.18/25.83/20.17 respectively. â—† Haitong Group (600537) â–² The company's restructuring was approved by the Ministry of Commerce, and high-quality PV assets could be injected. The company announced that the Ministry of Commerce agreed in principle to the replacement of Changzhou Yijing Optoelectronics and Haitong Group. Although the review by the China Securities Regulatory Commission will take time, it is more likely that the reorganization will not be financed. I believe that the long wait for asset injection may be about to pay off. If the restructuring is successful, the listed company will own 100% equity of Changzhou Yijing Optoelectronics, and thus become a vertically integrated large-scale photovoltaic enterprise. Yijing Optoelectronics has outstanding competitive advantages in the domestic PV market: 1) Vertical integration and integrated production mode, cost control and quality control are strong; 2) Management structure is compact, and decision-making and execution efficiency are high. It is easy to achieve rapid development in the market boom cycle. In 2010, the company's production capacity will expand from 200MW to 400MW, and it plans to expand to 1GW within three years to join the first echelon of the domestic PV industry. â–²In the first half of this year, PV spot supply is tight, and the future will continue to be booming. This year, due to the high return on investment, the European PV market continues to heat up. At present, the spot market in the supply side has been reluctant to sell, and the prices of polysilicon, silicon wafers, battery chips and components all show a strong trend. At present, domestic large factories including Yijing Optoelectronics have a full-scale production in full year. We believe that the photovoltaic market will continue to support the economy: 1) countries supporting the photovoltaic market will expand from individual countries to many economies around the world; 2) the approach of affordable Internet access will enable photovoltaic power generation to usher in the dawn of large-scale commercial operation; 3) Photovoltaic In the next 10 years, the cost leadership will be strengthened and will become the main technical means for the development of new energy. â–²The global PV market has gained growth opportunities. China's PV industry has benefited the most. With the new installations in Germany, Italy, the United States and the Czech Republic, it is expected to increase significantly on the basis of last year. Many authoritative research institutions have continuously raised the forecast for new installations this year. capacity. In 2010, it will increase by 90% to 12.2GW. In the next three years, the new installed base compound growth rate of 40%; considering the price decline factor, the solar cell market capacity compound growth rate of 33%. The price of polysilicon will remain relatively low, and the cost advantage of alternative technologies such as thin film is no longer the mainstream of crystalline silicon cells. Chinese companies will be able to continuously expand their market share due to the strengthening of cost advantages and the outbreak of domestic and foreign markets, and establish advantageous market advantages. â–²2010 P/E ratio is less than 24 times, and the compound growth rate in the future is over 30% According to local media reports, in the first half of the year, EJ Optoelectronics achieved sales of nearly 1.5 billion yuan and profit of 350 million yuan. The sales target of 3.8 billion yuan for the whole year is expected to exceed. The company's new capacity is expected to increase in the third quarter, and shipments in the second half of the year are expected to be 1.5 times that of the first half of the year. As the ex-factory price of components in the second half of the year rose slightly, the average price is expected to be no lower than the first half of the year, and the cost is basically stable, so the company's second half results will be significantly better than the first half. â–² 6-12 month target price: 36 yuan. The EPS granted to the company for 2010-2012 was 1.23/1.49/1.76 yuan respectively. The corresponding PEs are 23.05/19.03/16.01. â—† Other PV industry companies can pay attention â–² Sanan Optoelectronics (600703), target price of 6-12 months: 55 yuan. â–² Rongxin shares (002123), 6-12 months target price: no. â–² CSG A (000012), 6-12 months target price: no.

Photovoltaic Industry Research Report

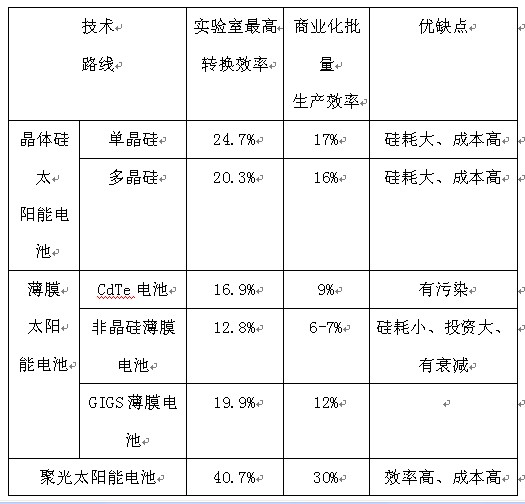

★ Global PV technology development briefs The solar radiation received by the Earth's surface can meet the global energy demand by 10,000 times. According to the International Energy Agency, installing solar photovoltaic systems in 4% of the world's desert is enough to meet global energy demand. Power generation can be used on roofs, building surfaces, open spaces and deserts, and the potential is enormous. ◆ Brief History of Photovoltaic Power Generation When the 19-year-old French beckleer did a physical experiment in 1839, it was found that when two kinds of metal electrodes in the conductive liquid were irradiated with light, the current would be strengthened, and the "photovoltaic effect" was found. In 1904, Einstein published a paper on photoelectric effects, and in this way he won the Nobel Prize in 1921. In May 1954, Bell Labs, Fuller and Peel of the United States released the silicon solar cell with an efficiency of 6%. This is the world's first practical solar cell. ◆Comparison of major photovoltaic power generation technologies Solar photovoltaic technology is a technology that converts solar energy into electricity. Its core is semiconductor materials that can release electrons. The most commonly used semiconductor material is silicon. The solar photovoltaic cell has two layers of semiconductors, one is a positive electrode and the other is a negative electrode. When the sunlight is irradiated on the semiconductor, a current is generated at the junction of the two poles, and the greater the intensity of the sunlight, the stronger the current. Solar photovoltaic systems can not only operate in strong sunlight, but also generate electricity on cloudy days. Due to the reflection of sunlight, the weather of Shaoyun is even better than that of sunny days. ▲Three main photovoltaic cell technologies are currently used in three types of photovoltaic power generation technologies: crystalline silicon solar cells, thin film solar cells and concentrating solar cells, of which crystalline silicon cells are the most widely used, accounting for more than 80%; thin film batteries have grown in recent years. Rapidly, accounting for more than 10%; concentrating solar cells have a small number of applications. Among the three kinds of photovoltaic power generation technologies, crystalline silicon batteries have the advantages of high conversion efficiency and small floor space. The disadvantages are high silicon consumption and high cost, which are more suitable for urban areas; thin-film solar cells have the advantages of low silicon consumption. The cost is low, and the disadvantages are low conversion efficiency, large investment, large attenuation, large floor area, and are suitable for integration of grid-connected power stations and buildings in remote areas; the advantages of concentrating batteries are high conversion efficiency, and the disadvantage is that they cannot be dispersed. Sunlight, the tracker must be used to adjust the system to the exact opposite of the sun, currently used primarily for aerospace. It is expected that in the future, photovoltaic power generation will present a variety of technologies coexisting, and work together to reduce costs. Table 1 Comparison of three main photovoltaic power generation technologies