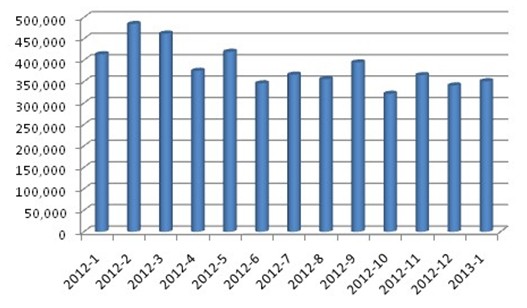

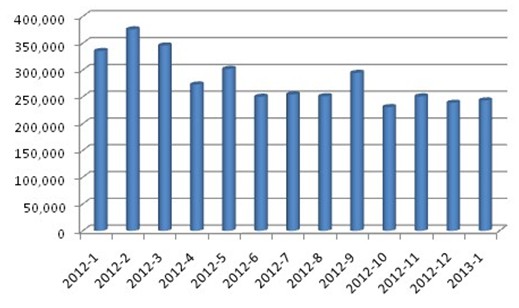

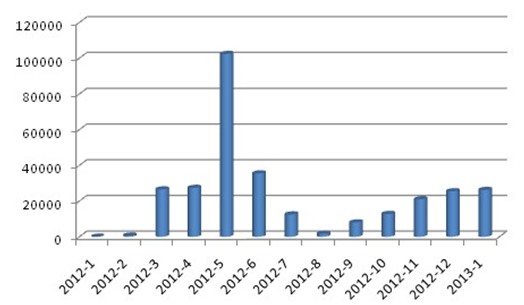

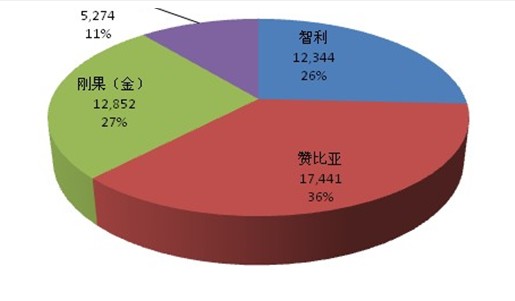

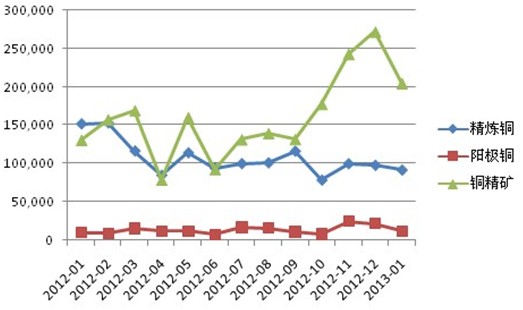

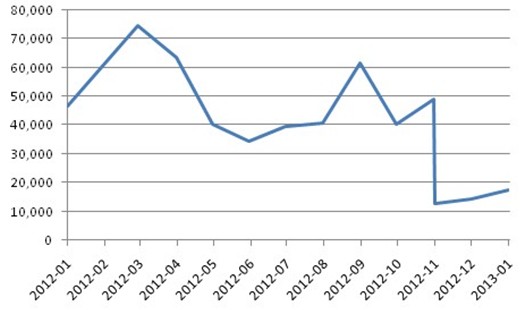

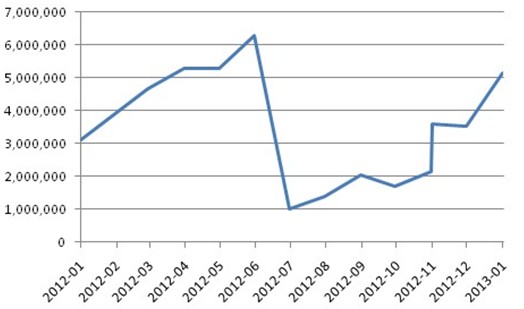

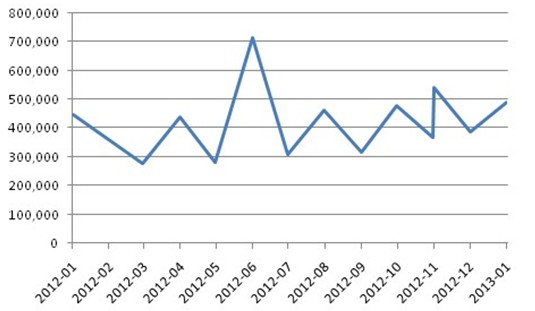

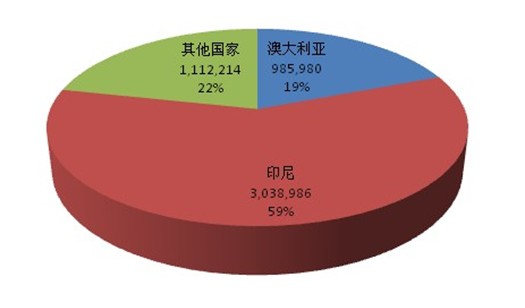

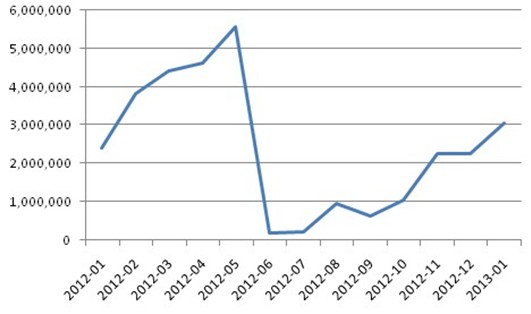

In January, China’s refined copper imports fell by 27.51% year-on-year to 243,174 tons, the fourth-straight year-on-year double-digit decline, but it was still generally in the fourth quarter of 2012, but given the volume of imports in the first quarter of last year. With a sharp increase, the ratio of refined copper imports in China will remain weak for a period of time. China's refined copper imports are most concerned by metal traders. Most market analysts expect that the quantity of refined copper imports from China will decline in the coming months, as many domestic consumer companies will reduce their annual contract purchases. If imports do not decrease, the reasons are also due to the lack of demand from manufacturers rather than downstream manufacturers. Business. While imports were sluggish, exports in January increased from 25,486 tons in December to 26,213 tons, which rose for the fifth consecutive month, mainly because domestic stocks remained high. The data show that the current stock exchange of copper in the Shanghai Exchange has jumped to 200,000. A record high above the ton. As China's self-sufficiency in the supply of refined metals increases, potential export flows will become an important issue for the Japanese economy. Based on data from past months, it is inferred that China's refined copper exports in 2013 may reach 300,000 tons. In January, China’s copper concentrate imports fell for the first time in seven months, from 935,303 tons in December last year to 761,098 tons; however, as important as the import and export of refined metals, the import of concentrates has accelerated in the near future, making it difficult to obtain copper concentrates. With the improvement of the smelting conditions, it may lead to a strong increase in concentrate imports in the coming period of time. China's imports of unwrought copper and copper materials decreased by a significant 15.22% year-on-year to 350,958 tons. Figure 1. Imports of unwrought copper and copper (unit: tons) Figure 2. Refined copper imports (units: tons) Figure 3. Refined copper exports (units: tons) In January, as China’s largest copper raw material trading partner, Chile’s exports of copper ore, anode copper and refined copper to China all decreased. Among them, anode copper decreased sharply by 43.9% year-on-year to 12,344 tons, copper ore decreased by 24.7% to 204,786 tons, and refined copper also decreased by 6.25%. Affected by this, Zambia has become China's largest source of copper anode imports. Figure 4. Source distribution of anode copper imports in January (unit: tons) Figure 5. Monthly imports of refined copper, anodic copper and copper concentrates exported to China by Chile (unit: ton) China's primary aluminum imports in January were much lower than its exports of aluminum products. As a net importer of aluminum, January's net import of raw aluminum in China was 2,350 tons, which was the lowest since November 2011. China has become a net importer of aluminum since the first half of 2009, when the arbitrage window was affected by the Chinese government’s purchase of strategic reserves. However, the data also shows that China has still been a net exporter of aluminum alloys and semi-finished products. China's primary aluminum imports increased for the second consecutive month in January, a slight increase of 21.24% to 17.437 tons, but it was still 62.63% lower than the 46,600 tons in January 2012. Due to the impact of domestic preparation of domestic electrolytic aluminum enterprises before the Spring Festival, the import of alumina and bauxite continued to stabilise. In January, total alumina imports rose by 26.12% to 488,088 tons, of which only alumina imported from Australia increased by 102,380 tons. , China's refinery capacity expansion and alumina production capacity growth are not synchronized, which means that alumina imports may steadily increase in the coming months. However, the data shows that China exported 230,000 tons of aluminum in January, reflecting the continuous increase in China's metal refining capacity, which is particularly true for aluminum. China's exports of semi-finished aluminum products have been stable between 224,400,000 tons per month since the middle of last year. In January, they exported 230,000 tons of semi-finished aluminum products. However, given that the increase in domestic supply will accelerate the growth of exports, the export of aluminum products should be closely watched in the coming months. Figure 6. China's primary aluminum imports (units: tons) Figure 7. China's bauxite imports (units: tons) Figure 8. China's alumina imports (units: tons) Prior to this, imports of bauxite, which was once forced by Indonesia’s forced export restrictions, continued to rise last month, increasing by 45.14% from the previous quarter to 5,137,180 tons. After a period of seven months, it rebounded to above 5 million tons. Among them, bauxite from Indonesia rose by 34.95% to 3,038,986 tons in December. Figure 9. China's primary source of bauxite imports in January (unit: tons) Figure 10. Monthly change in bauxite exports to China from Indonesia (unit: tons) Tct Circular Saw Blade,Tct Metal Cutting Blade,Tct Blade For Metal Cutting,Tct Circular Saw Blade For Metal DANYANG HANFENG TOOLS CO.,LTD. , https://www.hanfengdiatools.com

January 2013 Copper and Aluminum Imports and Exports

In the first month of 2013, China’s metal imports fell sharply year-on-year, and exports increased for the fifth consecutive month, indicating that traders are more willing to choose exports when inventory levels are high and post-holiday demand picks up slowly.