Led Bulb,Light Bulb,Smart Bulb,Led Light Bulbs Jiangmen hengshenghui Lighting Co., Ltd , https://www.jmsunbright.com PMI is an important economic indicator. Every time the published data is accompanied by a more volatile market, how to use PMI to analyze the market trend is of great significance to investors. With the global central bank setting off a wave of monetary easing, international commodity prices have skyrocketed, and domestic steel prices have also experienced significant volatility in the recent past. They have fallen day after day, and prices have skyrocketed every other day. Therefore, we need to deal with market changes more calmly. . Analyzing the relationship between PMI and steel price changes may give us a new idea to observe this market.

PMI is an important economic indicator. Every time the published data is accompanied by a more volatile market, how to use PMI to analyze the market trend is of great significance to investors. With the global central bank setting off a wave of monetary easing, international commodity prices have skyrocketed, and domestic steel prices have also experienced significant volatility in the recent past. They have fallen day after day, and prices have skyrocketed every other day. Therefore, we need to deal with market changes more calmly. . Analyzing the relationship between PMI and steel price changes may give us a new idea to observe this market.

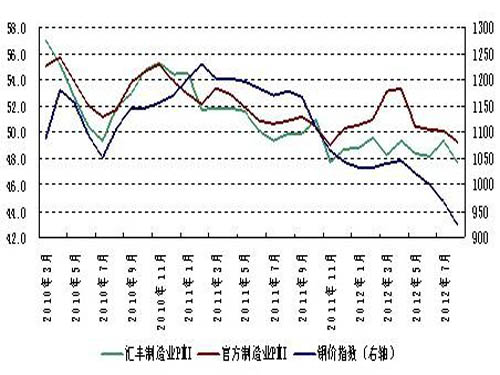

The manufacturing PMI has the same trend as the steel price trend. As the upper reaches of the manufacturing industry, the steel industry has always undertaken the key task of supplying a large number of steel raw materials and intermediate products to the downstream. The economic conditions of the manufacturing industry will directly affect the demand of the steel market, and The final reflection will be on the trend of steel prices. We have superimposed the manufacturing PMI and Fubao Steel Price Index, and intuitively we can see that the trends in manufacturing PMI and steel prices show strong convergence.

The author made further analysis of the correlation between manufacturing PMI and Fubao Steel Price Index from March 2006 to August 2012 (see Table 1). As can be seen from the results, the correlation between HSBC's manufacturing PMI and Fubao Steel's price index is significantly higher than that of the official PMI. Therefore, HSBC's manufacturing PMI has a stronger reference in the trend of steel prices. The correlation between PMI and steel prices reached the highest value at the first stage of lag, and then gradually weakened, indicating that the trend of manufacturing PMI can better reflect the overall trend of steel prices within the next month. It can not only be used as The leading indicators of the macro economy are also more reliable for the prediction of the price trend of the steel market. Therefore, we will use the PMI data of the manufacturing industry to make some quantitative predictions of future steel price trends.

Table 1 Correlation coefficient between Fubao steel price index and manufacturing PMI

The current value lags behind in the first-phase lag, second-phase lag, three-phase lagging steel price index and HSBC manufacturing PMI correlation coefficient 0.594754 0.678129 0.649975 0.599373 correlation coefficient between steel price index and official manufacturing PMI 0.516728 0.541647 0.474436 0.418158

The main cause of the weak manufacturing non-sustained decline may not be surprising to many people's consistency in the trend of PMI and steel prices, but the causal relationship between the two is not clear. Is PMI's expansion (or shrinkage) - or the manufacturing industry's economic conditions - causing the price of steel to rise (and fall), or is PMI just another reflection of the trend of steel prices? We can roughly see the clues through the famous Granger causality test.

Table 2 Granger Causality Test of Manufacturing PMI and Fubao Steel Price Trend

Assumed Probability Results Official Manufacturing PMI is not Granger due to steel price index 89.34% Accepted Raw Assumption Steel Index is not the official manufacturing PMI Granger due 1.29% Rejected the original hypothesis HSBC Manufacturing PMI is not a steel price index Gran 53.38% of Jyne accepting the original hypothetical steel price index is not the HSBC manufacturing PMI Granger because of 1.95% reject the original hypothesis From the final result, whether official or HSBC PMI is not the main cause of steel price fluctuations, but the market price The changes will eventually be reflected in the PMI data. From this we can see that the manufacturing industry as an important downstream of the steel industry, the short-term impact on market prices can not be ignored, but the determination of its long-term trend is not decisive. If we want to change the difficult situation in which the price of steel products keeps declining, we can achieve this by changing the relationship between supply and demand in the short-term, such as the Maji Construction Project. However, the long-term effect is limited, and the fundamental solution may still depend on improving quality to achieve stronger results. The competitiveness of the products can only occupy a place in the market. Just as economists have repeatedly emphasized that technological innovation and progress are the only driving forces for economic growth, the long-term driving force for steel prices will also come from this. When a solid foundation is established and internal strength is the direction of development of the industry, the rise in steel prices has become a matter of course.

The slight rebound in steel prices in October may be due to the impact of external "shock." Economic variables often deviate from the average temporarily, but over time, this deviation will be gradually corrected and the system will revert to The long-term equilibrium state is the self-regulating mechanism in the course of economic operation. Therefore, it is important to filter “shock†to find long-term trends in changes. It can not only help us to judge the direction of the medium- and long-term market, but also can provide guidance for our short-term decisions.

Here, we use the method of cointegration test to analyze the market's mid-to-long term operating trends. The forecast results show that for each 1% change in the current PMI value, the corresponding Fubao steel price index changes in the same direction to 1.3%, which means that the Fubao steel price index is usually more volatile than the official PMI data. The official PMI relatively underestimates the steel market. The speed of price changes, while the price fluctuations in the first-phase lags further expands to 1.4%, and the forecasting accuracy will continue to decline. The HSBC PMI, on the other hand, changes its current value by 1% and the corresponding Fubao Steel Price Index changes by only 0.9%. The first-phase lag coefficient was only 1.1%, which is closer to the market than the official data. Therefore, we use the HSBC manufacturing PMI data for quantitative analysis.

From September's initial rise of HSBC PMI 0.2 to 47.8, the moderation in the decline in the steel market price will continue into October, and it may show a slight rebound. Although the overall magnitude may be relatively limited, it will have a negative impact on the market. Confidence is undoubtedly a welcome boost.

Main conclusions Based on the above analysis, we can see that the manufacturing PMI can better estimate the steel price trend, and the HSBC PMI can be relatively more referential; while the steel price fluctuations will be reflected in the PMI in the short term, but The weak downstream demand is not the main reason for the long-term downtrend; the low technical content and homogeneity have seriously weakened the market competitiveness of steel products. Therefore, the long-term rise in steel prices must be accompanied by technological progress and industrial upgrading. May appear.

In addition, the forecast results obtained after quantitative analysis showed that the steel price may rebound slightly in October. Although the upside is relatively limited, it is still worth looking forward to whether the apparent boost in market confidence can engender a rebound in the market.